You probably understand that, but some new traders think that there's a way to always be sure of a winning trade. The first thing to understand is that you cannot “confirm” any trading signal, in a way that would guarantee a profitable outcome. Here's an example of bullish divergence on the AUDCHF.

The higher low in the RSI does not have to be in the oversold area for the signal to be valid. Next, look for a lower low in price action and a higher low in RSI. Image: TradingView Bullish DivergenceĪs you would expect, bullish divergence is just the opposite of bearish divergence.įirst look for an oversold signal on the RSI indicator. So it can help to re-enter a trade if your basic analysis of the trade stays the same. If you didn't take the second divergence, then you would have been stuck with a loss. You might have traded the first divergence and possibly been stopped out. One thing to notice about this example is that there are 2 divergence signals here.

-636724840350956874.png)

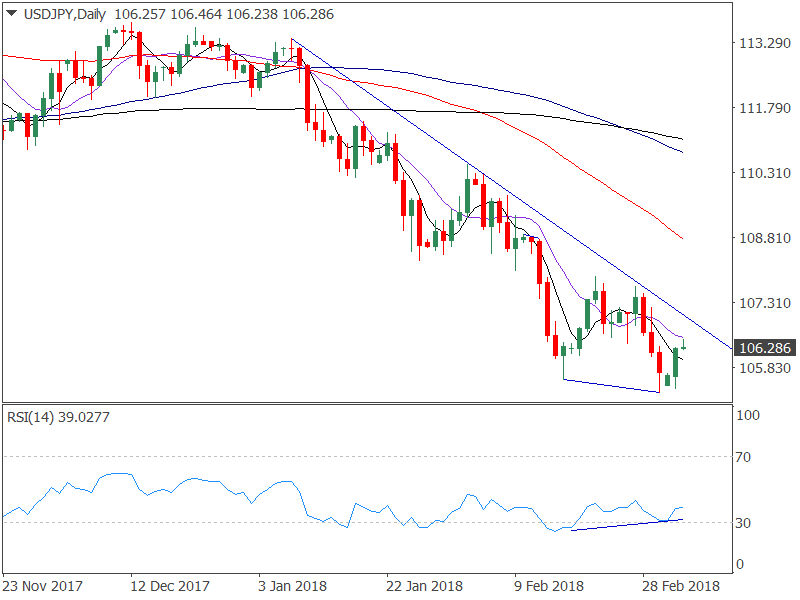

This can give you a hint that upward momentum is slowing down and a downward move could be coming soon. Price finds 2 new highs, but on the RSI, there are 2 new lows. SEE ALSO: 19 Powerful Positive Affirmations for Traders Bearish Divergence In other words, it helps traders spot potential price reversals. You can think of it as an early warning signal.

What is RSI Divergence?Īnother way to look at RSI divergence is that RSI can show a change in price momentum, before you see a change in price action. Now let's take a closer look at some examples of RSI divergence and how you can use it to identify potentially profitable trading opportunties. Simultaneously, price must form a lower low on the second peak. In a bullish divergence situation, there must be an oversold condition on the RSI, followed by a higher low on the RSI graph. At the same time, price must make a higher high on the second peak, where the RSI is lower. A bearish divergence consists of an overbought RSI reading, followed by lower high on RSI. RSI Divergence occurs when the Relative Strength Index indicator starts reversing before price does. But how does it work and when does it stop working?

Using divergence is a popular way to identify potential trading opportunities.

0 kommentar(er)

0 kommentar(er)